[FEATURE – 15 min read]

There is no better way to understand the power of technology and traceability tools like the Digital Product Passport, than by looking closely at the luxury accessories market.

While the physical forms of luxury bags and jewellery differ, their roles in modern lifestyles are closely aligned. Both serve as intimate symbols of identity, milestones, and personal storytelling.

“Consumers today look for pieces that reflect who they are and the life they aspire to live. Whether a bag or a necklace, these objects become part of their personal narrative.”

— Angela Ahrendts, former CEO of Burberry, Business of Fashion Voices, 2017

The evolution of the luxury bag industry, which grew from US$10 billion segment in the late 20th century to an estimated US$80 billion powerhouse today, is not just a story of growth. It is a story of how innovation, transparency and emotional connection can transform an entire category.

For the luxury jewellery industry, this journey offers vital lessons and compelling opportunities for the future

A Century of Growth

For most of the 20th century, the luxury bag stood quietly as a symbol of heritage and intimate indulgence. It was more than an accessory, it was a private token of success. These bags represented personal milestones, from first promotions to special anniversaries. They were purchased behind closed doors in hushed boutiques, often after years of saving or waiting.

For decades, bags from houses like Hermès, Chanel and Louis Vuitton were not just beautiful objects but archives of personal history. They were rarely flaunted beyond close circles. A Chanel Classic Flap might stay with one family for decades, passed from mother to daughter as a private heirloom.

“A luxury handbag was not meant to shout. It was an intimate companion, a private celebration of one’s personal achievements and milestones.”

— Pierre Hardy, designer for Hermès, Financial Times, 2015

Women like Grace Kelly had turned bags into cultural icons. In the 1950s, she famously used her Hermès bag to shield her pregnancy from photographers, transforming the piece into the now-famous Kelly bag.

Jane Birkin inspired the creation of the Birkin bag in 1981 for the same brand after a chance encounter with Hermès chairman Jean-Louis Dumas.

Princess Diana was so frequently photographed with her Dior bag in the 1990s that it became officially known as the Lady Dior.

These women did not just carry bags, they carried stories that transcended seasons and fashion cycles.

By the early 2000s, Bain & Company’s annual Luxury Goods Worldwide Market Study valued the global personal luxury goods market at around US$150bn. Yet bags were still a contained segment within this, guarded fiercely by scarcity.

They were exclusive products for niche audiences.

The idea of a pre-owned luxury bag would be met with scepticism. Bags were meant to be cherished, not traded. The language around them was about legacy and craftsmanship, not investment or asset value.

Yet the world of discreet, personal luxury was on the edge of a transformation that would take bags out of private closets and place them into a global spotlight, driven by forces that few could have predicted.

A Catalyst for Change

The global financial crisis of 2008 sent shockwaves through every corner of the economy.

Stock markets collapsed, banks fell, and millions of people lost their jobs and savings.

In the midst of this turmoil, the luxury market found itself at a crossroads. For the first time in decades, even the wealthiest consumers hesitated before making discretionary purchases. The air of invincibility that had long surrounded luxury began to crack.

“The financial crisis shattered the myth that luxury is immune. Even the most affluent clients paused, reconsidered, and re-evaluated their purchases.”

— Claudia D’Arpizio, Bain & Company, Luxury Goods Worldwide Market Study, 2010

Yet rather than disappearing, luxury adapted. In this period of fear and instability, consumers began to think more carefully about how and where they placed their money.

They looked for products that not only offered emotional satisfaction, but also value retention. Luxury bags, already seen as rare and carefully crafted, started to be viewed through a new lens.

Bags from Hermès and Chanel, once simply admired as fashion icons, began to be described as “investment pieces.”

In 2008 a Hermès Birkin bag sold at auction for over 80,000 dollars, surprising many outside the industry and signalling a shift in how these items were perceived. Buyers started to realise that some bags did not just hold their value, they could even appreciate over time.

In this fragile climate, exclusivity turned into a kind of security. Owning a bag that could potentially be resold or even increase in value felt more like an intelligent decision than an indulgence.

Insights from Bain & Company revealed that while the global personal luxury market contracted by around 9 percent in 2009, certain categories like iconic bags held steady, driven by this new narrative of value.

This was a subtle but important shift. It marked the beginning of luxury being seen not only as a symbol of taste and success but as a possible financial asset. In the ashes of economic collapse, the seeds of a new luxury mindset quietly took root.

Cultural Renaissance and Conscious Consumption

As the dust from the financial crisis settled, a deeper cultural shift began to emerge. Consumers started to question not just the price of what they bought, but its meaning and impact. The era of flashy, purely status-driven consumption began to give way to a quieter, more reflective approach. People wanted to feel that their purchases were justified, both ethically and financially.

This shift was visible across many sectors, but it resonated powerfully in luxury.

A new movement began to grow, often described as “buy less, buy better.” Rather than chasing seasonal trends, consumers sought timeless pieces, crafted with care and intended to last. Bags, already seen as durable and iconic, fit perfectly into this evolving mindset.

“Consumers opt for ‘quiet luxury’ in crisis”

— Financial Times, 2009

As Anna Wintour noted at the time:

“People are looking for pieces that will stand the test of time. They want investment buys rather than something disposable.”

Luxury shoppers began to see a well-made bag not just as an accessory but as a statement of values. It spoke to quality, longevity and craftsmanship, standing in contrast to the throwaway mentality that had dominated parts of the fashion industry for decades.

Chanel’s focus on classic lines and enduring design began to feel more relevant than ever. Hermès continued to reinforce its narrative of artisanal mastery, with each bag taking hours of skilled handwork.

“Sixty-six percent of global consumers say they’re willing to pay more for sustainable brands — up from 55% in 2014 and 50% in 2013.”

— Nielsen, The Sustainability Imperative, 2015.

Karl Lagerfeld summed it up succinctly:

“Luxury is not the same as extravagance. It is about the lasting value of a beautiful thing.”

This new wave of conscious consumption created fertile ground for the next evolution in luxury. Bags were no longer simply objects to be acquired, they became objects to be understood, respected and eventually, passed on or resold.

The Social Media Revolution

While conscious consumption was beginning to reshape the mindset of luxury buyers, another force was emerging that would change not just luxury, but global culture as a whole. Social media, led by the rise of Instagram in 2010 and later TikTok in 2016, transformed the way people discovered, shared and desired fashion.

For luxury bags, this shift was seismic. What was once private and personal suddenly became global and performative. A bag was no longer simply carried into a boardroom or dinner party. It was photographed, tagged and shared with millions.

“Instagram has completely democratized fashion. It used to be only the front row, now it’s the whole world.”

— Eva Chen, former editor-in-chief of Lucky and early Instagram fashion partnerships director

Instagram created a new kind of cultural currency. Luxury bags, with their instantly recognisable silhouettes and logos, became the perfect subjects for this visual language. Influencers and celebrities posted carefully curated images that made a Chanel Flap or a Dior Saddle bag feel both aspirational and accessible. A single post could create waiting lists overnight and elevate a design from niche to icon.

“A single post can make a product sell out overnight. This is power that we have never seen before.”

— Luca Solca, luxury analyst at Bernstein

As early as 2014, Instagram reported that 90 percent of its users followed at least one business account, and fashion was among the most dominant sectors. By 2017, social media had become a primary source of fashion inspiration for over 70 percent of millennial luxury consumers, according to Bain & Company.

“Instagram Is Rewriting the Rules of Luxury Marketing.”

— The New York Times, 2015

Luxury brands adapted quickly. Rather than resist, they leaned into this new openness, using social media to stage launches, build behind-the-scenes stories and collaborate with digital tastemakers. Dior’s “Lady Dior As Seen By” project and Gucci’s partnerships with artists and micro-influencers reflected this new strategy.

A luxury bag was no longer just a private emblem of success. It became a piece of a personal brand, a digital signature shared across continents in seconds. This transformation helped propel bags into cultural icons, embedding them deeply into daily life and sparking new levels of desire and collectability.

The Early Rise of the Resale Market

While social media pushed luxury bags into the global spotlight, another transformation was beginning to take shape behind the scenes. The idea of resale, once confined to discreet consignment shops and vintage boutiques, started to find a new, more ambitious home online.

In 2009, Vestiaire Collective was founded in Paris with a simple idea: to make pre-owned luxury fashion as desirable and trustworthy as buying new.

“We wanted to create a trusted community where people could buy and sell pre-owned luxury fashion without fear.”

— Fanny Moizant, co-founder of Vestiaire Collective (Business of Fashion, 2017)

Just two years later, The RealReal launched in the United States, bringing professional authentication and a polished online experience to the resale space.

“Authentication is at the heart of what we do. It is the number one reason people were afraid to buy second-hand luxury online, and we knew we had to fix that first.”

— Julie Wainwright, founder of The RealReal (Forbes, 2017)

Historically, the idea of buying a second-hand luxury bag carried stigma. Many consumers worried about fakes, poor condition or simply the perception that pre-owned meant less valuable.

“Consumer trust remains the main barrier to growth in the second-hand luxury market, with authenticity and product condition cited as top concerns.”

— Bain & Company, Second-Hand Luxury Report, 2017

These early resale pioneers addressed these fears head-on, investing heavily in authentication teams and strict condition standards. Shoppers were offered clear images, detailed descriptions and guarantees that rivalled, and in some cases surpassed, those of brand boutiques.

Luca Solca, a leading luxury market analyst, reinforced the ambition:

“Without trust, the second-hand luxury market would remain a niche curiosity. Authentication and quality control are not optional, they are the foundation.”

— Luca Solca, Business of Fashion, 2018

Larger cultural forces supported this shift.

The growing focus on sustainability made consumers more open to circular models of ownership. According to a 2018 report by ThredUp, the second-hand apparel market was expected to double between 2018 and 2022, reaching US$41 billion in the United States alone. Luxury bags, with their enduring desirability and strong resale value, sat right at the heart of this surge.

What began as a quiet undercurrent started to gain momentum, laying the foundation for a future where luxury bags would not only be purchased but actively traded.

This was no longer about a one-time indulgence.

It was the beginning of a more dynamic and open market, ready to blur the lines.

Data Driven Marketing and Personalization

As luxury brands adapted to the digital era, they began to see data not just as a tool for operations but as a key to deepening emotional connections with customers. The rise of social media and e-commerce meant that brands could collect insights on individual preferences, browsing patterns and purchase histories at a scale never imagined before.

“We must understand every client, anticipate their desires, and create a connection that feels deeply personal. Data allows us to do that without losing the soul of the brand.”

— Bernard Arnault, Chairman and CEO of LVMH (Financial Times, 2018)

With this new wealth of information, brands like Louis Vuitton, Dior and Gucci started to refine their approaches. Rather than broadcasting a single global message, they tailored communications to resonate with each client’s personal tastes and aspirations. The once strictly guarded world of luxury started to become surprisingly intimate.

“The future of luxury is in creating a unique, personalised experience for each client. Data is not about surveillance, it is about service.”

— Marco Bizzarri, CEO of Gucci (Business of Fashion Voices, 2017)

Personalisation strategies included customised email campaigns, private client events and early access to limited releases. Algorithms learned what styles a client favoured, which colour palettes they preferred and even how they responded to different types of messaging. A loyal customer might receive an invitation to preview a new collection, while a first-time buyer might be guided toward timeless entry pieces.

“Personalisation at scale has become the new frontier for luxury brands, enabling them to strengthen loyalty while maintaining exclusivity.”

— Bain & Company, Luxury Goods Worldwide Market Study, 2018

By 2018, Bain & Company reported that 80 percent of luxury brands had invested significantly in data-driven marketing and clienteling initiatives. This shift was not only about selling more but about forging relationships that felt genuine and long-term.

“In luxury today, it is no longer about who knows the most people. It is about who knows their people the most.”

— Angela Ahrendts, former CEO of Burberry, 2013

This focus on data-enabled intimacy created new opportunities for bags in particular. A bag was no longer just an object in a glass case. It became a suggested companion on a journey, a reflection of the wearer’s personal story and aspirations.

The combination of digital insights and old-world craftsmanship forged a new model of luxury, one where technology amplified rather than diminished the human connection.

Digital Storytelling and the New Luxury Narrative

As luxury brands embraced data and deeper customer insights, they discovered a powerful new tool: digital storytelling. Unlike traditional advertising campaigns that relied on polished perfection and static imagery, digital storytelling allowed brands to create immersive, evolving narratives that could connect with consumers in real time.

“Storytelling Is the New Currency for Luxury Brands.”

— Business of Fashion, 2017

The digital world offered something that print ads and runway shows never could: immediacy, interactivity and intimacy. Through social media, websites and immersive online experiences, customers could follow a bag’s journey from initial sketch to the artisan’s workbench and finally into the hands of its first owner. This transparency transformed the relationship between brand and buyer from transactional to emotional.

“Digital touchpoints influence 75% of luxury purchases, even when the transaction happens offline. Storytelling is no longer optional, it is a central pillar of brand strategy.”

— Bain & Company, Luxury Market Report, 2018

Design innovation also played a crucial role. Many luxury houses began releasing behind-the-scenes videos, artisan interviews and “making of” content, showing the meticulous care behind each piece.

“Consumers today want to understand the soul of a product, to know the hands and the stories behind it. This is why we open our ateliers to the world.”

— Pietro Beccari, CEO of Dior (Vogue Business, 2019)

In parallel, richer product information became a central pillar of this storytelling shift. Detailed materials sourcing, care instructions and even historical references gave customers a sense of depth and permanence.

“Consumers expect brands to be transparent, authentic and to share detailed narratives about craftsmanship, heritage and sustainability.”

— Deloitte, Global Powers of Luxury Goods Report, 2019

“A bag is no longer just a product, it is a story in motion. Our job is to give it meaning, to make it part of the customer’s own story.”

— Michael Burke, former CEO of Louis Vuitton (Financial Times, 2018)

The characteristics of digital, constant connectivity, shareability and the ability to layer rich media content, made these stories come alive. Digital platforms allowed for direct feedback, community sharing and co-creation moments, where customers felt part of an ongoing story rather than passive observers.

As Angela Ahrendts once said, “You have to create a brand that invites people in, that they want to be a part of.” In this new narrative-driven luxury model, bags stopped being silent status symbols and started becoming living stories. Each purchase marked the beginning of a shared journey between maker, brand and wearer, weaving the customer into the fabric of the brand itself.

Technology Enabled Authentication and Provenance

By the late 2010s, as the luxury resale market matured and storytelling deepened emotional bonds, technology began to redefine the luxury bag industry’s approach to trust and value. The traditional reliance on expert eyes and paper certificates started to give way to a new generation of digital tools, designed to provide confidence at scale.

Around 2017, artificial intelligence began to play a transformative role. Companies like Entrupy introduced AI-powered authentication specifically for luxury handbags. Using microscopic imaging and advanced algorithms, these systems could verify a bag’s authenticity with over 99 percent accuracy in minutes, far surpassing human capacity.

“Our AI-powered authentication brought science to what was once a subjective art. It enabled confidence at scale for luxury bags.”

— Vidyuth Srinivasan, CEO of Entrupy (Business of Fashion, 2018)

At the same time, advanced CRM platforms began helping brands collect and analyse detailed customer data, from style preferences to purchase patterns, enabling more personal narratives and tailored service. This data-driven intimacy created opportunities to suggest new pieces, build loyalty programs, and nurture long-term relationships, enhancing satisfaction and conversion rates.

The next major leap came in 2021, when LVMH, Prada and Cartier jointly launched the Aura Blockchain Consortium. Through blockchain-backed digital certificates, these brands began offering customers full transparency about their bags, from material sourcing to manufacturing processes and ownership history.

“Consumers deserve to know that what they buy is authentic and responsibly sourced. Blockchain allows us to share the product journey with absolute confidence.”

— LVMH, Aura Blockchain Consortium launch, 2021

All of these technologies converge in the digital product passport (DPP), which has emerged as the central tool for securing and sharing a luxury bag’s full story. Embedded technologies like NFC chips and QR codes give each bag a permanent, scannable digital identity.

“Digital certificates and AI-led authentication have become essential in the fight against counterfeits, particularly in the luxury handbag sector where trust is central to value.”

— Bain & Company, Luxury Goods Worldwide Market Study, 2021

For consumers, these advancements provide immediate confidence and strengthen emotional connection. For retailers, they open doors to value-added services, from maintenance and resale facilitation to exclusive upgrades, all supported by a credible digital record. For manufacturers, verified provenance protects brand equity, enables higher price premiums and supports new circular models such as certified pre-owned programs.

The Manufacturers Advantage

While much of the discussion around new technologies focused on building trust and enhancing the consumer experience, their true strategic value had been equally profound for manufacturers and retailers.

For the luxury bag industry, embracing advanced authentication, digital storytelling, and digital product passports proved to be more than a defensive move against counterfeits, it became a driver of commercial success.

“Brands that demonstrate clear provenance and craftsmanship see up to a 20 percent premium in price realization, reinforcing exclusivity and supporting long-term brand equity.”

— Bain & Company, Luxury Goods Worldwide Market Study, 2021

Manufacturers discovered that verified provenance and transparent supply chains did more than protect brand integrity. They reinforced exclusivity and justify price premiums, supporting long-term brand equity.

“Transparency and storytelling allow us to justify our price positioning and connect emotionally with clients. This is the true value of opening up our manufacturing story.”

— Jean-Marc Pontroué, CEO of Panerai (Business of Fashion, 2019)

Retailers saw powerful results. With a secure digital record in place, they offered services that extended the lifetime value of a customer, from repair and maintenance to buy-back and resale facilitation.

“Luxury brands with advanced digital engagement and service models see conversion rates 30 to 50 percent higher than peers who do not invest in these tools.”

— McKinsey & Company, State of Fashion: Luxury Edition, 2021

The introduction of certified pre-owned programs also unlocked new revenue streams. By controlling the secondary market, brands recaptured value that would otherwise go to third-party resellers. Gucci’s experimental Vault platform and Richemont’s Watchfinder acquisition are early examples of how major players moved strategically into this space.

“Our ability to track and certify the entire journey of a product has transformed our relationship with the customer. We are no longer just selling a bag, we are selling a promise.”

— François-Henri Pinault, CEO of Kering (Financial Times, 2020)

Ultimately, the integration of digital tools not only safeguarded the industry but expanded it.

Retailers and manufacturers found that when they proved authenticity and shared deeper stories, they not only sold more but created loyal communities willing to return, upgrade, and invest in the brand journey repeatedly.

Scale, Acceleration and the Covid Catalyst

By the late 2010s and into the early 2020s, the luxury bag market had entered a period of remarkable growth and transformation. Both new and resale segments expanded rapidly, fueled by technological innovations, shifting cultural values and powerful global events.

Market growth was reflected in Bain & Company’s Luxury Goods Worldwide Market Study data, along with brand-specific annual reports from major players such as LVMH, Kering and Hermès.

The new luxury bag market alone was estimated to have grown from around US$45 billion in 2014 to approximately US$80 billion by 2024.

This expansion reflected strong consumer appetite for luxury, driven by rising middle-class wealth in Asia, a global desire for timeless investment pieces and the storytelling power of digital marketing.

“Luxury is more resilient than many think. Even during crises, our clients look for pieces that hold emotional and financial value.”

— Jean-Jacques Guiony, CFO of LVMH (Financial Times, 2020)

At the same time, the resale market saw an even more dramatic surge. From an estimated US$5 billion in 2014, it climbed to around US$20 billion by 2024. Our estimate is supported by triangulating multiple sources, including BCG and Vestiaire Collective reports, Bain & Company analyses and ThredUp’s broader resale projections.

“Resale Market Expected to Grow to $36 Billion by 2024 as Consumers Embrace Circular Fashion.”

— BCG x Vestiaire Collective Report, 2020

The COVID-19 pandemic acted as a powerful accelerator. Store closures and travel restrictions pushed both brands and consumers further online, making digital channels and resale platforms not just alternatives but necessities.

“Digital engagement and strong brand equity allowed us to continue growing even when physical stores were closed.”

— François-Henri Pinault, CEO of Kering (Business of Fashion, 2021)

While global economic uncertainty dampened discretionary spending elsewhere, luxury bags held strong. The emotional connection, combined with their perceived investment value, kept demand high even in turbulent times.

Brands responded quickly, investing heavily in online experiences, virtual consultations and digital storytelling to maintain engagement. Resale platforms, meanwhile, capitalised on consumers’ renewed interest in sustainability and value retention, further solidifying the second-hand luxury bag market as a mainstream choice.

“Resale is no longer just a trend. It is a structural shift in how luxury is bought and valued.”

— Max Bittner, CEO of Vestiaire Collective (Vogue Business, 2021)

Together, these forces propelled the industry into a new era where both new and pre-owned bags thrived side by side. The market’s rapid growth underscored not just a temporary spike but a lasting shift in how luxury is consumed and valued.

The Future for Luxury Accessories

As the luxury bag market looks to the future, the line between new and pre-owned is expected to blur even further. Rather than viewing these as competing categories, brands are beginning to see them as complementary parts of a single, evolving ecosystem.

“Controlling our resale channels and investing in certified pre-owned is not an experiment. It is a long-term strategy to maintain brand equity and capture new generations of clients.”

— Antoine Arnault, LVMH (Business of Fashion, 2021)

Certified pre-owned programs, already pioneered by watchmakers and some fashion houses, are likely to become standard for luxury bags. By offering authenticated resale directly through brand-controlled channels, companies not only retain a share of the secondary market but also deepen customer loyalty. Customers will feel more confident trading in and trading up, creating a virtuous cycle that supports both new sales and brand equity.

“We believe that controlling every stage of a product’s life cycle, including resale and authentication, is essential for the future of luxury.”

— François-Henri Pinault, CEO of Kering (Financial Times, 2021)

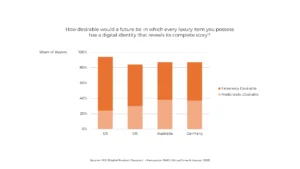

The integration of digital product passports and advanced authentication will become universal. By 2025, Bain & Company expects that as many as 25 percent of all personal luxury goods will include some form of digital proof of authenticity and provenance. This shift will empower consumers to make more informed decisions, knowing precisely where and how their pieces were made.

“Vault is our laboratory for the future of luxury, combining new creations with vintage and pre-owned pieces. It is a space to experiment with circularity and new client relationships.”

— Gucci official statement (Vogue Business, 2022)

At the same time, consumers are increasingly looking for meaning and personal narrative in every purchase. Younger generations, especially Millennials and Gen Z, place high value on sustainability and social responsibility. According to a 2021 report by Deloitte, nearly 60 percent of Gen Z consumers prefer brands that demonstrate environmental and social values, reshaping how luxury must behave in the coming years.

As resale, digital innovation and storytelling converge, the luxury bag becomes less of a static object and more of a dynamic cultural asset. It moves fluidly between owners, gathering stories, maintaining value and reinforcing a community of passionate advocates.

“The future of luxury will not be defined solely by scarcity, but by transparency, circularity and emotional connection.”

— Claudia D’Arpizio, Bain & Company (Luxury Goods Worldwide Market Study, 2022)

The next chapter of luxury is not about creating more products but creating more meaningful relationships, relationships that extend far beyond the initial purchase and continue to evolve over a lifetime.

The Lesson for Luxury Jewellery

As the luxury bag market has shown, technology, transparency and storytelling are no longer optional extras. They are core to building trust, increasing perceived value and creating long-lasting relationships with consumers.

Many in the luxury jewellery sector continue to resist these shifts, often arguing that jewellery is fundamentally different. It is more timeless, more personal, and less subject to trends. Yet it is precisely these qualities that make jewellery so perfectly suited to the same evolution that transformed the bag market.

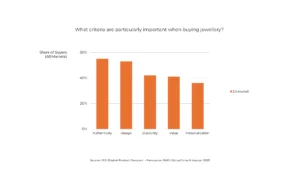

Today’s consumers want to know the story behind every piece they purchase. They expect proof of authenticity, ethical sourcing and craftsmanship. They value transparency and are willing to pay a premium for it.

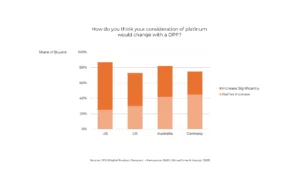

Digital product passports, AI-powered authentication and rich storytelling content offer jewellery brands the tools to meet these expectations directly.

When consumers can see and verify a piece’s origin, materials and journey, their emotional connection deepens. They feel not just like owners but like custodians of something meaningful. This emotional value, combined with proven authenticity, strengthens purchase intent and supports higher price points.

Jewellery brands that adopt these tools today can unlock new opportunities. They can introduce certified pre-owned programs, create lifelong service relationships and enable consumers to trade up and invest further. These approaches do not diminish the magic of jewellery. They amplify it.

The lesson from luxury bags is clear. By embracing transparency and technology, brands do not lose their mystique. Instead, they invite consumers deeper into the story, transforming them from buyers into lifelong brand ambassadors.

The future of luxury jewellery is not just about creating beautiful objects. It is about creating enduring connections, building trust and weaving each client into a narrative that lasts far beyond the moment of purchase.